We introduce some things to be paid attention when foreigners file their tax return for refund to tax office with jurisdiction in Japan. We hope this article help your tax procedures.

目次

Basic rules

Following cases are well known as samples of the reason of tax return for refund.

・You have paid significant medical expenses.

・You have constructed a house as a dwelling with a housing loan.

But in this time we will mainly cover points of attention concerning deduction from income related to relatives who live in overseas.

|Tax refund procedure

Basically, employee need not to file tax return because their company take the year-end adjustment. But when you have dependents in overseas and missed submitting “application for exemption for dependents of employment income earner”, you can submit tax return for refund directly to tax office with jurisdiction.

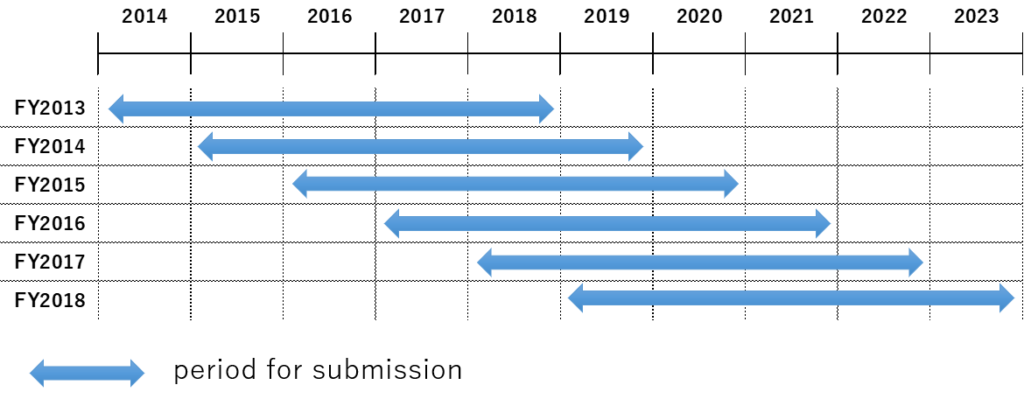

In the case of tax return for refund, you can submit it anytime for five years. For instance, tax return for refund in 2018 fiscal year can be accepted by the tax office with jurisdiction from the beginning of Jan. in 2019 to the end of Dec. in 2023.

Please refer to following schedule of tax return for refund.

When you submit tax return for refund for multiple fiscal years to tax office with jurisdiction, you should separate them into each fiscal year with other required documents.

|Required documents

For instance, if you would like to apply exemption for dependents about your spouse’s parents in overseas, you have to prepare your certificate of marriage and spouse’s certificate of live birth as “concerning relatives documents”. These documents are generally used for tax refund procedures.

In addition, you have to prepare copy of remittance report or usage details of credit card as “concerning remittances documents”.

Please be aware that you have to remit living expenses to each bank account when you would like to apply for tax allowance about multiple dependents.

Other points of attention

Following cases are sometimes found at some tax offices or venues for tax return. In these cases applicants can not receive tax refund, so you might want to pay attention at your tax return procedure.

case 1

Concerning relatives documents or concerning remittances documents are not attached tax return form.

case 2

If educational expenses for child in overseas are remitted to other family member’s bank account, the child is not applicable for your tax allowance. You have to remit to the child’s bank account.

case 3

When money for living expenses or educational expenses are directly handed over to dependents in overseas with no remittance, you won’t be eligible for tax allowance.

case 4

If you moved your residence, you need to renew residence description on the reverse side of your residence card at the city office which is closest your new address.

case 5

If you came from Vietnam, please note that application issued by People’s Committee in Vietnam is not applicable as “concerning relatives documents”.

Conclusion(まとめ)

You had better obtain withholding tax report from your company early. If you don’t have it when you file tax return for refund, tax officials would urge you to make the company issue it.

We can assist your tax procedure at reasonable price. Please do not hesitate to contact us.